How to become an SME bank customer and open a current account?

Legal entities, as well as non-residents and electronic money institutions (EMIs), can open a current account with SME Bank remotely. Customers usually open a bank account within 30 minutes.

Just 6 steps to becoming a customer

- Confirmation of identification – identification of the person wishing to open a bank account.

- Filling in the Know Your Customer (KYC) form and signing in one of three ways: mobile signature, qualified Smart ID signature or using biometrics. Submission of company documents.

- Submission of company documents.

- Document authentication by the bank’s AML employee.

- The signing of the contract.

- Connecting to online banking.

The customer registration process is fully automated and performed remotely in a way most convenient for the customer. Form completion can be suspended at any stage and resumed at another convenient time.

What documents do you need to open an account?

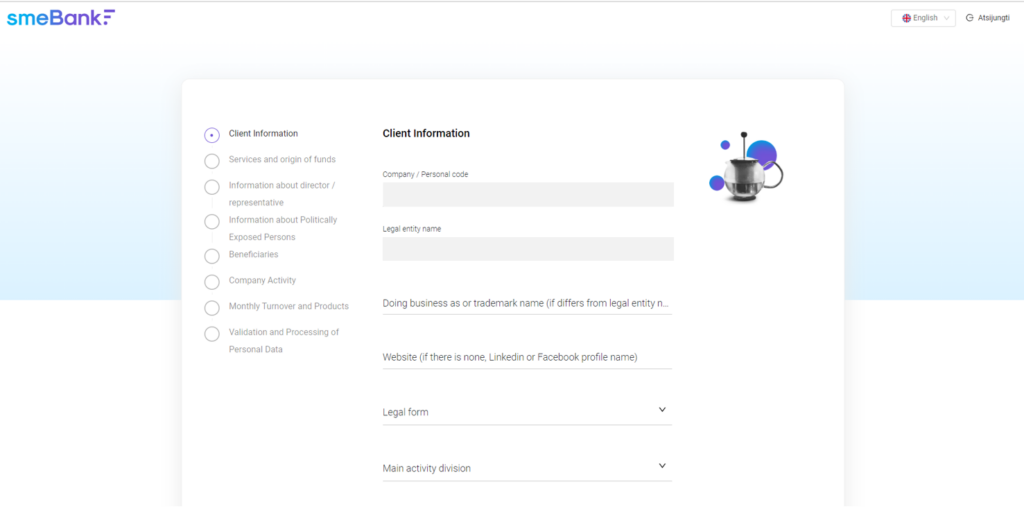

When completing the customer application, you will need to provide following: the organisational structure of the company, the company’s articles of association, the identity document of the director or his/her authorised person, and the identity document of the final beneficiary. Depending on the type and activities of the company, the bank may request additional documents. All submitted documents must be signed.

You will also need to complete the Know Your Customer (KYC) form.

What is Know Your Customer (KYC) form and why does the bank request it?

International legal acts and the Republic of Lithuania Law on the Prevention of Money Laundering and Terrorist Financing oblige banks to know their customers and to collect and store information related to them. We ask every customer to submit the Know Your Customer (KYC) form, the purpose of which is to get to know the customer’s business, identify the final beneficiaries and implement the requirements of the Law on the Prevention of Money Laundering and Terrorist Financing, i.e., prevent money laundering and protect customers from fraud. Information for the KYC form is obtained both directly from the customer and from the registers, at the request of the bank. We ensure that the information provided is considered to be confidential information constituting the bank’s secret and will be stored in accordance with legal requirements.

Who can become an SME Bank customer?

Legal entities as well as non-residents and electronic money institutions (EMIs) can become customers of the bank. The bank account can be opened remotely by the head of the company or any employee authorised to represent the company.

What is biometrics?

We will perform an identity verification process to confirm that your document data matches your face on the phone camera during a live call.

How long does Ondato UAB store data?

The personal data that you provide to the bank’s partner Ondato UAB during the identification process will be processed until the remote identification procedure of your identity is completed and the results are transferred to the bank. By choosing to continue your identity verification, you acknowledge and agree that you have been informed that Ondato UAB may store your personal data for remote identification received in the process thereof for a period longer than is necessary for the identification and transmission of its results to the bank, however, only upon the bank’s request or in case of a contractual obligation of Ondato UAB to the bank, but no longer than provided for in the contract signed between Ondato UAB and the bank. You can request your personal data at any time and receive more information by e-mail ([email protected]) or you can review the service provider’s policy, which is available here.

Where can I find the contracts? We will send you the signed current account and online banking contracts via email. You can find the general terms and conditions of the contracts here.

If you have any questions, please e-mail us at [email protected] or call +370 601 88888.

Just 6 steps to becoming a customer:

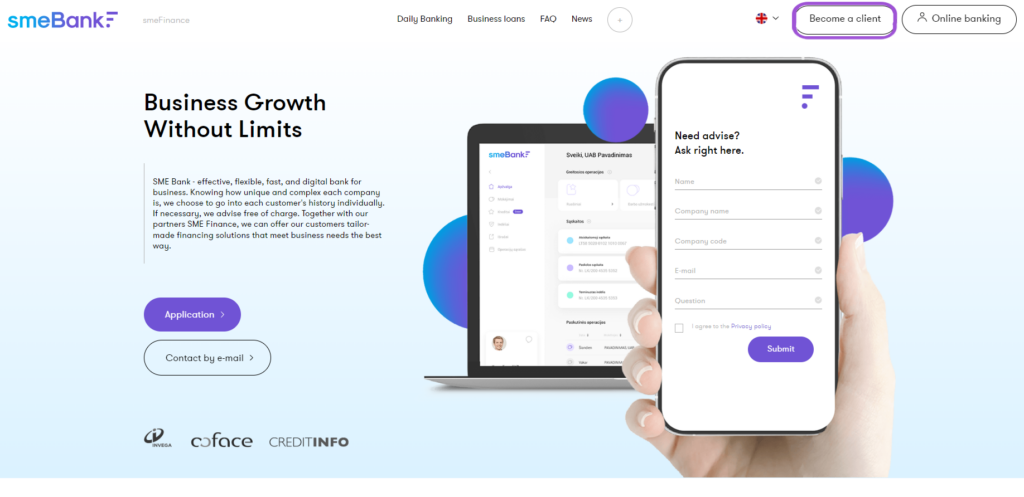

You can become an SME Bank customer by clicking the “Become a Customer” button in the upper right corner on the bank’s website. It usually takes about 30 minutes for our customers to complete the process.

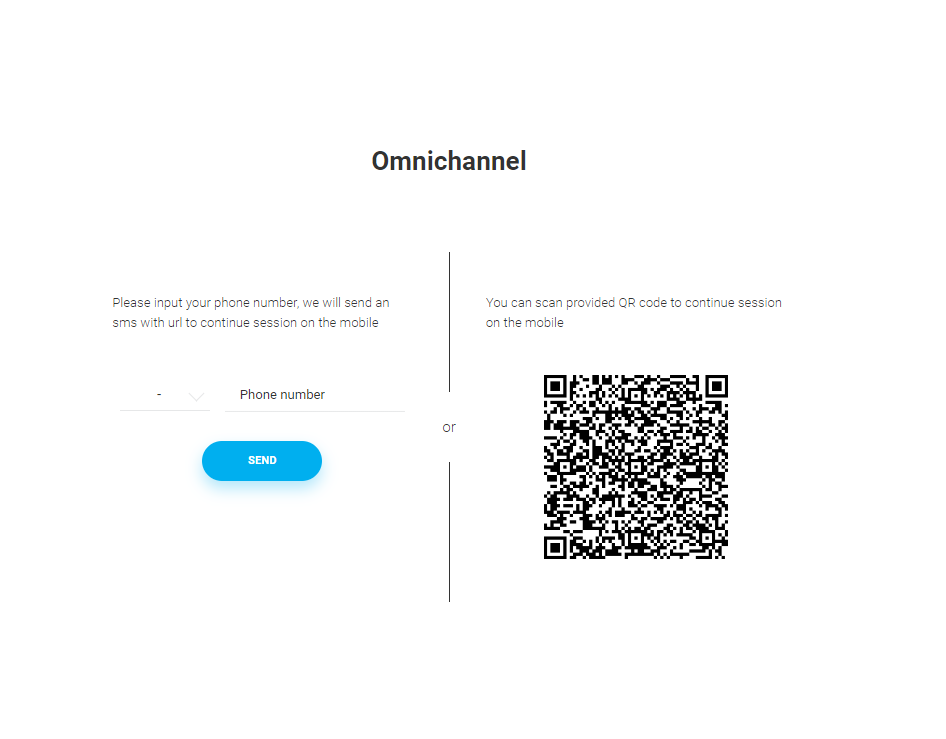

Confirm your identity

In order to identify you, we cooperate with Ondato UAB, which will verify your identity remotely using biometrics. Choose the most convenient method for you: verify your identity by using a phone number or by scanning the QR code displayed on the screen.

After confirming your identity, enter the details of the represented company on your phone.

Fill in the KYC form and sign it with a mobile signature, qualified Smart ID signature or using biometrics.

Upload all requested company documents to the system.

Document authentication

The AML employee of SME Bank will check all the submitted documents; in case of doubt the bank representative may request additional documents. We will inform you by e-mail, if you are required to provide additional documents.

Online banking login information

After signing the contract, you will receive online banking login information by e-mail. If you are unable to log in, please email us at [email protected] or call +370 601 88888.

What should you do if remote customer registration failed?

If you are unable to successfully complete customer remotely, please e-mail at [email protected] or call +370 601 88888.

Have questions?

Email us at [email protected] and we will contact you.

Sveiki

Sveiki